He downgraded the stock to neutral from buy and removed his price target following the report.Īnother downgrade came from Raymond James analyst John Davis, who predicted that the company’s weaker-than-expected commentary would keep its stock in check until the company is able to show a reacceleration in growth as well as trends that prove its guidance to be “overly conservative.”

Read: Visa stock sees biggest post-earnings gain on record amid optimism on travel spending In Palmer’s view, PayPal cited various outside issues like inflation and supply-chain pressures as reasons for its cautious outlook, but such a stance “offered a sharp contrast with the more upbeat annual outlooks offered recently by the card networks.”

#PAYPAL STOCK PRICE FOR 12 MONTHS FULL#

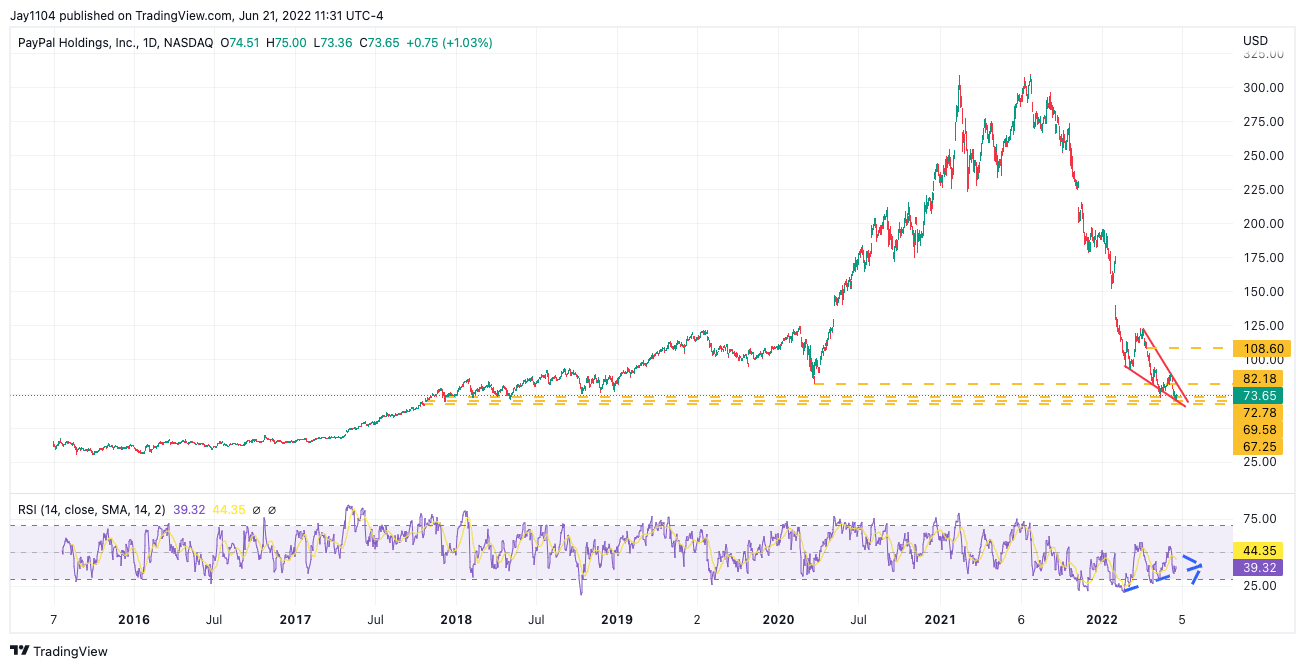

Subscribe: Want intel on all the news moving markets? Sign up for our daily Need to Know newsletter.īTIG’s Mark Palmer also keyed in on the new active-account strategy as PayPal now expects 15 million to 20 million net new active users for the full year, down from almost 50 million such additions in 2021 and “well below expectations of a year-over-year increase in that metric rather than a steep decline.”Īdditionally, Palmer commented that PayPal’s view of spending trends seemed more negative than what fellow payments players Visa Inc. She has a market-perform rating on the stock and cut her price target to $140 from $180. “There is a lot to unpack, but we believe this quarter may signal the beginning of the next phase of PYPL’s journey – slow transition to a mature company & may likely bring some aging pains (& multiple compression) in the coming years,” Rawat wrote in her note to clients. The company “abandoned” its target for 750 million users by 2025, a goal it provided about a year ago and “reiterated throughout the year,” Bernstein’s Rawat said. Still, the change came as a shock to analysts. “The new approach sounds sensible to us as many of the new accounts proved less productive,” wrote Susquehanna’s James Friedman, who has a positive rating on the stock but lowered his price target to $220 from $310. PayPal executives said they no longer planned to focus on “incentive campaigns” meant to reengage less active users because these didn’t drive sustained spending activity beyond the initial “incentive.” Chief Financial Officer John Rainey called the move a “choice” as PayPal seeks to give priority to financial results over user growth that might not meaningfully impact revenue. user growth to drive revenue growth,” wrote Bernstein analyst Harshita Rawat. The company noted that factors such as inflation, supply pressures, and softer consumer confidence were weighing on spending patterns.īut “the biggest negative surprise was an abrupt change in strategy to focus more on user engagement (& quality) vs. Late Tuesday, PayPal lowered its full-year revenue outlook from the initial target it gave three months back and delivered a full-year earnings forecast that was below the consensus view. The stock has come down 57% from its 52-week intraday high established in July 2021, and it logged its lowest close since May 2020.

0 kommentar(er)

0 kommentar(er)